Nigeria remains one of Africa’s largest oil producers, but for the past six months, it has been surpassed by the continent’s other major producer, Angola. Insecurity in the Niger Delta is largely to blame. The Cipher Brief’s Kaitlin Lavinder spoke with Director of the CSIS Africa Program Jennifer Cooke about Nigeria’s oil conundrum and why an unstable and economically unhealthy Nigeria is not in U.S. interests.

The Cipher Brief: How powerful is the state-owned Nigerian National Petroleum Corporation (NNPC)? How much of the market share does it control?

Jennifer Cooke: The Nigerian National Petroleum Corporation is extremely powerful within the oil sector. Every foreign partner that invests in Nigeria’s oil sector must enter into a joint venture with the NNPC, and it also sets regulations for the sector. It’s a very important player, a very big player, and a very opaque player within Nigeria’s energy sector.

TCB: In addition to the NNPC and these foreign entities that enter into partnerships with the NNPC, are there local, privately owned oil companies in Nigeria?

JC: Yes, there has been a number of indigenous companies that have sprung up over the past eight years or so. Most have acquired assets from international companies, and in those cases, they have taken on the existing arrangement with the NNPC. Foreign energy investors have become somewhat ambivalent about Nigeria, given the security issues in the oil-producing areas and the failure to pass the Petroleum Industry Bill, which in turn means that there is a lot of uncertainty about how revenues are ultimately divided between the companies and the government. So it is in that space that a number of indigenous Nigerian companies have sprung up. But these smaller indigenous companies have been hard hit by the persistently low global oil price, and some just haven’t had the liquidity to withstand the persistent downturn. But the proliferation of these indigenous Nigerian companies is definitely a new phenomenon within the oil sector.

TCB: You mentioned the Petroleum Industry Bill (PIB) that has not yet passed. What is the current standing?

JC: It has been languishing in the legislature for eight years now. There have been about 20 versions of the bill in the interim. It is a massive bill that restructures the NNPC, deregulates the downstream sector, and sets new fiscal terms for oil exploration and oil operators. Partly because it is so ambitious and partly because there hasn’t been a champion within the Nigerian government to push the bill through the legislature, there have been different versions floated, but nothing has been passed. There is talk now about possibly breaking it up into separate more manageable pieces of legislation. As it stands now, however, with so much uncertainty over future fiscal terms, a lot of external investors have been holding back on investing in deep water blocs. No company wants to sink big investments in oil infrastructure without knowing exactly what the terms of the deal are. This means Nigeria has lost a lot of potential investment recently, which will affect oil production going forward.

TCB: I just reviewed the latest OPEC monthly oil market report and noticed Angola has surpassed Nigeria in crude oil production for six months in a row now, claiming the title of largest oil producer in Africa. Is this partially due to Angola having a more stable policy climate, compared to Nigeria?

JC: My sense is that it is primarily insecurity that has put Nigeria behind. Nigeria has greater production capacity – around 2.5 million barrels per day – and more than four times Angola’s proven crude oil reserves. Nigeria’s proven natural gas reserves dwarf Angola’s. Nonetheless, at certain points in the past, when there have been violence and insecurity in the Niger Delta, the two countries have been neck and neck in terms of production. The most recent insecurity in the Niger Delta has been devastating for oil production. Nigeria has gone from 2.2 million barrels per day to 1.4 million barrels per day, its lowest production level in a long time. That really is because of this insecurity – surgical attacks that have destroyed major pipelines and shut down oil export terminals.

TCB: What is the government doing to address this issue in the Niger Delta?

JC: As with the previous Niger Delta insurgency, the government has pursued a mix of negotiation and shows of military force. There was a negotiation process underway, which resulted in a ceasefire, but that was breached last week with a major attack on the Bonny export terminal. It is not entirely clear how this confrontation will be resolved. In the past, a very heavy military assault against the Movement for the Emancipation of the Niger Delta (MEND) was followed by a negotiation and an amnesty process, in which the government paid off the key leaders of the movement. A similar solution is not politically possible now, because the government is strapped for cash overall, and pay-offs have proven to be only a temporary solution. That does not seem to be a sustainable solution.

The new active militant group in the Niger Delta is the Niger Delta Avengers (NDA). Nobody knows for certain what combination of factors are motivating this group. There is some speculation that the attacks are push-back on President Muhammadu Buhari’s anti-corruption effort, which members of the former Goodluck Jonathan administration and other politicians from the Niger Delta view as a criminalization of their leadership.

So in addition to any potential military or security response, there is going to have to be a coming to terms with the political drivers of the militancy there as well. The issue in the Niger Delta is a mix of local grievances, political interests, and criminality all combined in complex ways, which makes it difficult to resolve.

TCB: What are U.S. interests in Nigeria, in the oil industry specifically, and in the economic well-being and stability of the country as a whole?

JC: Nigeria is an extremely important player within Africa. What happens in Nigeria matters a great deal to U.S. interests in Africa overall. It is the most populous country in Africa, it has just gone through a largely peaceful democratic transition in 2015, and there are a lot of economic opportunities within Nigeria beyond the oil sector. U.S. companies are looking at the size of the potential market—180 million people, a growing consumer class, and its linkages to other economies in West Africa. In the long term, in the next decade or so, Nigeria will become an increasingly important trade and investment partner for the United States.

With U.S. domestic production up, the United States no longer imports much oil from Nigeria, although it did in the past – about nine percent. But U.S. companies – Chevron and Exxon Mobil, for example – are still very involved in the oil sector there, and the U.S. has an interest in steady predictable global oil prices, which Nigeria, as a fairly significant player, can affect.

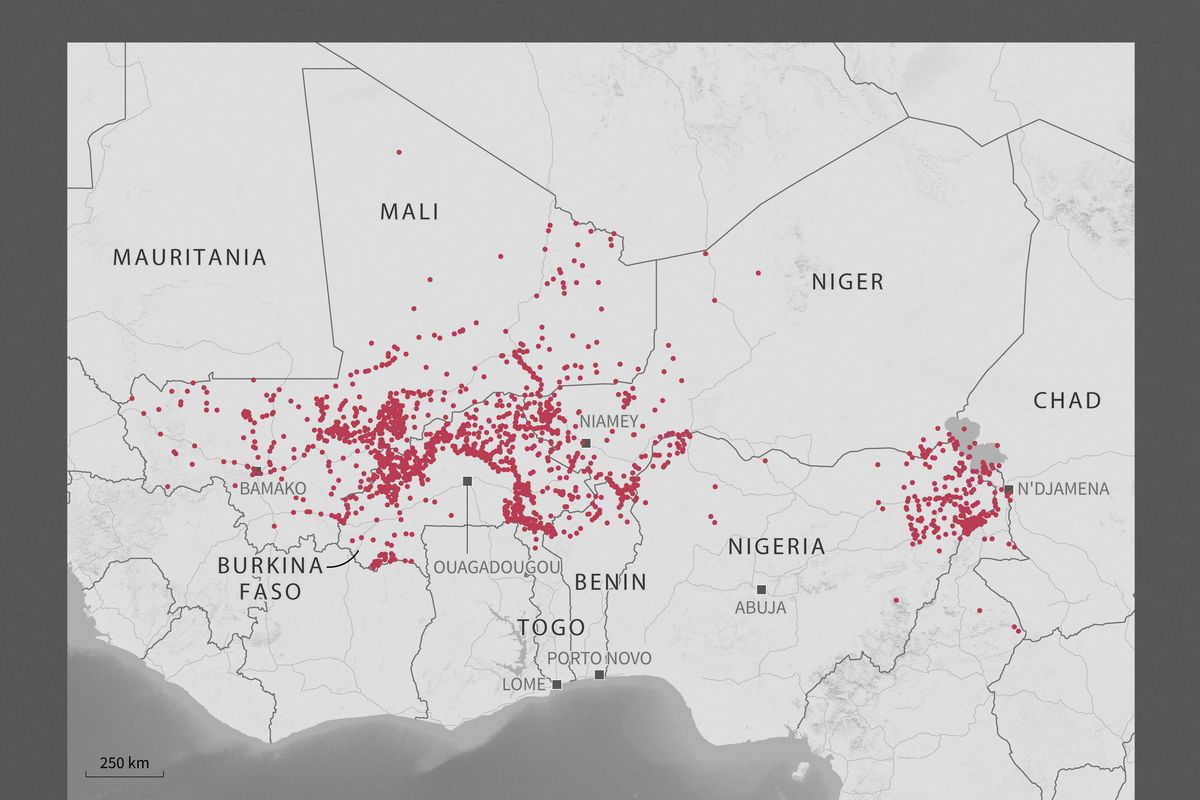

Nigeria is a big place, with lots of dynamism but also significant challenges. The Niger Delta is just one area of concern, along with violent extremist activity in the northeast by Boko Haram, intercommunal conflict across the middle-belt, and mounting violence between traditional herding communities and sedentary agricultural communities. The U.S. wants Nigeria to succeed and thrive. Insecurity and instability in Nigeria has huge ripple effects across the West African region.