In January, the Indonesian financial transactions agency claimed Bitcoin had been used by Islamic militants to fund terrorist activity there; last year, Salafi-jihadist groups designated by the United States as foreign terrorists were able to raise some $600 in bitcoins. These incidents raise alarms about the potential for virtual currencies to become a part of the terrorist financing toolkit.

So far, however, evidence for terrorist use of virtual currencies is anecdotal and episodic. Unlike the situation in the cybercrime context, where bitcoin is used pervasively by criminals looking to mask their identities, it is not yet a strategic counterterrorism threat. It may yet become one, though. For now, terrorist groups face important challenges in using virtual currencies at scale to fund their attacks. In particular, virtual currencies lack the convertibility that terrorist groups require to fund themselves sustainably.

In effect, terrorist groups are not using virtual currencies to finance their terrorism in a significant way because they simply do not yet need to do so. Other funding sources afford what they require, and have advantages that virtual currencies do not. For example, despite sizable investments in anti-money laundering and counterterrorist financing by banks, terrorist dollars still slip through. Terrorist groups also use cash to transfer value, allowing them to evade banking controls. Despite its insecurity, cash lets them conduct transactions quickly and with complete anonymity to purchase supplies and pay salaries. Terrorists also continue to use hawala networks, an international, trust-based system of money transfer that often exists outside of the formal financial system’s oversight controls.

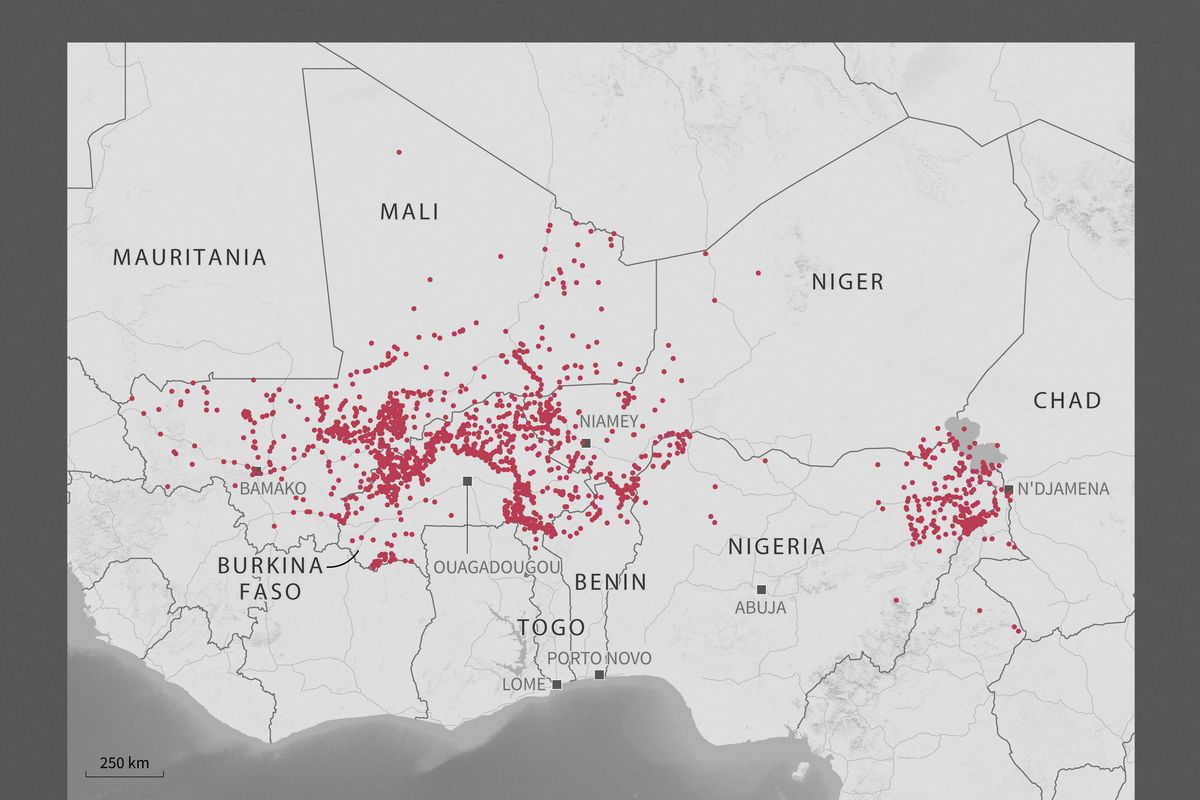

Compared to these more traditional methods of moving, raising, and storing funds, virtual currencies have certain drawbacks. Unlike wads of cash passed over a border, virtual currency is not immediately liquid enough to pay salaries or buy supplies. Instead, value moved through virtual currency needs to be reconverted into fiat currency to be usable by terrorist groups. By requiring conversion back into fiat currency, virtual currencies introduce more risk and another opportunity for disruption. Virtual currencies may also not be technologically possible; in many parts of the world where terrorist groups operate, the systems on which virtual currency run are inaccessible in a way that hawala networks, for instance, are not.

Cybercriminals’ recent and hearty embrace of virtual currencies can help illuminate the relative difficulties that terrorists face. Virtual currencies meet cybercriminals’ needs in particular ways. Virtual currencies allow for irreversible, immediate, and nearly anonymous transactions. In the context of attacks like the recent WannaCry ransomware epidemic, this clearly benefits the criminals. Funds cannot be held in escrow, and the user cannot demand a refund if the decryption key is not provided. The global nature of virtual currencies allows criminals to conduct attacks and collect money from all over the world. Moreover, the pseudonymity of bitcoin means the identities of the cybercriminals will remain in the dark absent a significant investment in forensics by law enforcement or security researchers. Certain technical tools make it much easier to conceal bitcoin transactions, as does laundering virtual currencies through other virtual currencies.

Of course, irreversible, immediate, international, and largely anonymous transactions could be appealing to terrorists as well. Unlike terrorists, however, cybercriminals are poised to take advantage of the particular kind of convertibility and network effects that virtual currencies provide. They do not need to convert virtual currency into fiat currency. Much of their business takes place in dark web markets, where they can traffic in software vulnerabilities and stolen data, continuing to operate in virtual currency. When they do need to convert their funds into fiat currencies, they are able to choose relatively unsupervised jurisdictions and exchanges. Virtual currencies also benefit from network effects among cybercriminals, particularly because dark web marketplaces emphasize a particular virtual currency, driving up its value.

Still, trends in virtual currency and counterterrorism strategy both demonstrate the possibility that virtual currencies could be used to systematically fund terrorism. Cryptocurrencies that explicitly prioritize privacy to allow for more anonymized transactions continue to proliferate, as do related tools to obscure transactions and ownership. Terrorists may develop a familiarity with these forms of financial technology, adding to their skills in social media and burgeoning use of drone technology. As law enforcement continues to strengthen its oversight of traditional sources of funding, virtual currencies, with their decentralized structure and limited oversight, will become more appealing as an alternative. Terrorists will likely have to create a wider funding base over the coming years, and will appreciate an international way to raise and move funds rapidly.

So, despite the lack of an immediate threat, the possibility of terrorist use of virtual currency should remain a concern for policymakers. Only small amounts of funds are currently being raised through virtual currency, and minor incidents may continue. Moreover, the current lone-wolf threat requires minimal funding to launch potentially devastating attacks. More immediately, terrorists could learn from the strikingly effective ransomware that cybercriminals have been deploying, and use it to fund an attack or enact an attack using the technology itself. A ransomware attack against critical infrastructure—including a healthcare system, as the world recently witnessed—could have potentially devastating effects and also bankroll terrorist groups.

Fortunately, policymakers have time to act to counter this potential threat. They can take a few steps in particular to help ensure that terrorist financing through virtual currencies never materializes at scale.

First, policymakers should emphasize greater understanding of how new financial technologies and how they may be used to support terrorist financing. Productive and sustainable innovation within financial technology should be encouraged and governments should consider risk-based approaches to focus on companies that are most vulnerable to abuse by terrorist financiers. In addition, there must be active collaboration among banks, technology providers, merchants, national security and law enforcement officials, and virtual currency exchanges to collect and share information about terrorist threats. The libertarian ethos of many financial technology firms and virtual currency exchanges, combined with constraints on financial institutions’ sharing information among each other and across borders, results in problems for information-sharing at a time when private-sector collaboration to understand terrorist networks and arrest plots is more important than ever. New regulation tailored to the specific context of virtual currency may be necessary to address the pseudonymity and decentralization inherent in the most prevalent virtual currencies.

These measures will help the counterterrorism community get ahead of the potential threat before it becomes another technological tool in terrorists’ arsenal.