OPINION — “Since the start of the [Ukraine] war, the liquid portion of the [Russian] national wealth fund has fallen by nearly half. Defense outlays in the budget have almost tripled from pre-invasion levels to roughly one third of the total, while the share of spending on domestic infrastructure and education has been frozen, resulting in a real cut to multi-decade lows. Tanks and mortars don't raise living standards. They destroy lives and productive livelihoods. Inflation and benchmark interest rates have subsequently risen to 8% and 16%, respectively, both more than double the G20 median.”

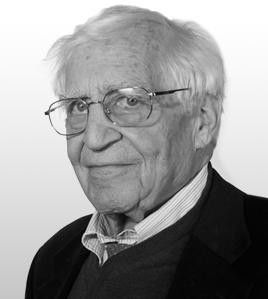

That was Daleep Singh, President Biden’s Deputy National Security Advisor for International Economics, the primary speaker last Tuesday at the Brookings Institution for a session entitled, “Sanctions on Russia: What’s Working? What’s Not?”

Singh, who has played a pivotal role in designing and implementing U.S. and allied country sanctions against Russia, went on to say, “Nosebleed inflation and interest rates will inevitably choke off Russia's growth. So will its loss of access to the world's leading financial centers, cutting-edge technology and many of the largest energy consumers. So will the immigration, conscription or flight of over a million citizens from Russia, so will the exit of more than a thousand multinational companies — less capital, less technology and less talent, implies a smaller, weaker, less productive Russian economy for a generation to come.”

I’ve not seen much written about the impact of sanctions on Russia but had been drawn to the Brookings session after reading news stories last Thursday about Russia raising taxes to pay for the war. As the Wall Street Journal put it, “The increases are meant to fund soaring government expenditures on a conflict that has transformed the Russian economy over the past two years.”

Singh’s opening presentation at Brookings was like an introductory course on sanctions.

He described as a “myth” the notion that “Russia is adapting and innovating around our sanctions and export controls, and we can't keep up.” Singh said, “Sanctions are like antibiotics. Repeat usage builds up resistance,” but that “Russia's near constant need to adapt and reorient its supply chains creates inefficiency, uncertainty and complexity. By dumping pounds of sand into the gears of Russia's war machine, we're forcing the Kremlin to rely on evermore elaborate and expensive procurement networks.”

Singh added that because of sanctions, Russia's imports of key electronic components “have fallen by roughly a third…[leaving] Russia to rely on less-reliable alternatives.” For example, he said that Russia has purchased so-called “lagging edge” [older technology] Chinese semiconductors, and some 40 percent have been defective. In addition, Singh said, other countries are charging steep premium prices for sanctioned goods.

Russian workarounds

Russia has continually sought to circumvent sanctions, so National Security Advisor Jake Sullivan, beginning after the February 2022 invasion of Ukraine, has convened a group of trade experts for regular, nearly daily meetings to determine countermeasures.

Since the war began, Singh said, “We've imposed sanctions and export controls on over 4,500 individuals and entities, many of which are front and shell companies, intermediaries and service providers in Russia or third countries that didn't exist prior to the invasion but were emerging as nodes in Russia's shadow production network.”

One thing Singh reported was surprising: “The percentage of Russian battlefield weaponry with U.S. or allied branded components is alarmingly and unacceptably high.” He called on U.S. and allied companies to “Know your customers, know their customers, and know the end users. Ensure that American firms are not unwitting cogs in Russia's arsenal of autocracy.”

Because Russia has shifted its entire economy toward war footing, and recently appointed Andrei Belousov, an economist, as Defense Minister, Singh said the U.S. is “looking to expand our own authorities…In this regard, we're actively exploring options to broaden the definition of financial facilitation in our sanctions regime, as well as the scope of our export controls for U.S. origin or U.S. branded products.”

Far from the headlines

Another sanctions impact that Singh disclosed was, as he put it, “one that by definition will never make headlines.” By that he said he meant “what's not happening because of the chilling effect of our actions and our warnings: The banking relationships and trade ties that don't exist; the investments that weren't made to front companies that were not created. It's why we engage a broad range of countries well outside our formal coalition in ways that aren't meant to be publicized with specific evidence of circumvention.”

As a result, he said, what he called “sanctions diplomacy” has had unpublicized success stories “from Eurasia to the Gulf to South and Central Asia.”

One of the hardest Russian sanctions for the U.S. and other countries to deal with, Singh said, was in the energy field, where the fear was spiking global energy prices.

“In the early weeks of the war,” Singh explained, “we [the U.S. and its allies] simultaneously cut off imports of Russian energy exports and surged global supply with releases from our strategic reserves.”

However, in a tight global market, quantity restrictions have led to price increases that translate into a net benefit for Putin's revenues and drive up global inflation, Singh said. To deal with countries that still bought from Russia, a price cap of $60-per-barrel was put on Russian crude oil sold to countries not participating in the embargo. It was set in December 2022 and took full effect in early 2023.

At the same time, the provision of financial services to companies transporting Russian crude, such as insurance to shippers, was prohibited unless there is verification that the oil is being sold below the price cap.

Although Russian export volumes have remained high, they are at a discounted price, as the U.S. and its allies have enforced the cap when Russia tried to evade it.

Singh said, “Our judgment is that the price cap, alongside our import bans and our sanctions, they have collectively reduced Russia's earnings. Russia's oil tax revenue dropped nearly 30% from 2022 to 2023, in part due to our sanctions.”

He called the price cap “a powerful template of statecraft in an increasingly weaponized global energy market.”

A Russian behemoth counts its losses

Another participant at Brookings last week was Agathe Demarais, a Senior Policy Fellow at the European Council on Foreign Relations and author of Backfire, a book on the global ripple effects of sanctions and export controls.

Demarais said she had studied the impact of the sanctions on Gazprom, Russia’s majority state-owned multi-national energy corporation, and reported it had posted a $6.8 billion U.S. dollar loss last year. She called those losses “extremely significant considering the company usually gives around $40 billion to Russian state coffers every year, either through contributions to the federal budget or the National Welfare Fund, which is the sovereign wealth fund.”

She added, “Gazprom isn't going to be able to contribute to the Russian budget. It's not going to be able to pay dividends, to its main shareholder, the Russian state. And of course, that's going to be a problem to finance the war.”

Singh was asked about whether sanctions had affected Russian President Vladimir Putin’s approach toward the Ukraine war. “I reflected quite a bit on, on whether we've influenced it,” he replied.

“President Putin's revealed preference is to think about this invasion, you know, much like an 18th- century land grab in the Tsarist tradition of Peter the Great, Catherine the Great. What he cares about most is what's happening on the battlefield. And while I believe strongly we're causing profound long-term economic damage to Russia and therefore his political standing…we have to understand that's probably a distant second in terms of his consideration.”

But Singh went on to make some broader points that are worth serious consideration.

“We're in the most intense period of great power competition in at least three decades, arguably in 70 years,” he said, and pointed out, “Now, today's great powers are nuclear powers. And that means, barring catastrophic miscalculation, direct confrontation is more likely to play out in the theater of economics and technology than direct military conflict.”

He went on to say, speaking of nuclear weapons, “Now, if that's correct, we have a lot of work to do to communicate to the world the guiding principles that constrain our use of these restrictive tools, that give them [people of the world] more comfort — that we're not going to fire these weapons in a way that's arbitrary or, or reflexive. Reflexive.”

He then said of sanctions more broadly, “We have to do a lot more work, I think, to build an analytical infrastructure that's fit for purpose, that really understands the limitations, the spillovers, and, and the efficacy of sanctions when they're used unilaterally, multilaterally.”

What Singh said he had in mind was “to have more balance in our conduct of economic statecraft,” meaning “we should convey a standing preference to use economic tools that offer the prospect of mutual economic gain, rather than feed a very, damaging perception that our marginal unit of time and energy and focus is on designing tools that inflict economic pain.”

He said he was talking “about tools like debt relief or infrastructure finance or supply chain partnerships or trade agreements. You know, these are the kind of tools that each have, I would argue, the potential to forge a more enduring alignment with countries that are skeptical of our use of economic statecraft.”

Using imagination and creativity, Singh said, “We ought to consider, should we have a sovereign wealth fund? Should we have a strategic petroleum reserve, or should it be a strategic resilient reserve that makes long term strategic investments at home and abroad? Can we use sovereign loan guarantees in a different way?”

In short, I read Singh as suggesting last week that U.S. competition with China, which is building up its nuclear weapons to become an armed nuclear peer, should not be met with more U.S. nuclear weapons –which seems to be the direct the U.S. is heading.Instead, Singh is saying, the U.S. should compete with the [Chinese] Belt and Road Initiative by strategic investments abroad through economic statecraft and, as he said, “I think laying down a doctrine will be a good start.”

The Cipher Brief is committed to publishing a range of perspectives on national security issues submitted by deeply experienced national security professionals.

Opinions expressed are those of the author and do not represent the views or opinions of The Cipher Brief.

Have a perspective to share based on your experience in the national security field? Send it to Editor@thecipherbrief.com for publication consideration.

Read more expert-driven national security insights, perspective and analysis in The Cipher Brief