The Cipher Brief interviewed Robin Miller, who advises firms on strategy and policy dedicated to global innovation as an Associate Partner at Dalberg Global Development Advisors. Miller explained what conditions in Sub-Saharan Africa have allowed for the rapid growth in information and communications technology, and what the outlook is for the industry.

The Cipher Brief: Sub-Saharan Africa has seen a rapid growth in the information and communications technology (ICT) industry. How would you compare the African ICT industry to other continents or countries?

Robin Miller: Unlike many countries in the Global North, the proliferation of access to technology in Sub-Saharan Africa over the last decade has been mobile-led (as opposed to desktop/browser-led). This creates distinct opportunities as well as challenges for business, government, and civil society alike.

Second, the infrastructure, both civil and digital (mobile and broadband) is much less developed than other countries, creating space for technology to dramatically disrupt economic development. The lack of road, electricity, and digital infrastructures has been addressed by new solutions that leapfrog legacy systems, solutions, and infrastructure. Mobile networks surpassing landlines was the obvious one, but there are others as well. In East Africa, digital solutions, such as mKopa, are leapfrogging the electricity grid by providing solar home lighting solutions and, in a few countries, mobile money and digital finance solutions are surging ahead of brick and mortar banking infrastructure. The “leapfrog” term may be overused, but the opportunity it represents stands.

TCB: Which countries are leading the way in the ICT industry? What has allowed for this rapid growth (government policies, economic conditions, demographic factors, etc.)?

RM: Nigeria is the first that comes to mind, largely because of its reputation for demand-driven tech businesses that are aggressively pursuing scale. For example, Iroko TV has closed funding rounds in excess of $30M, poised as one of the world’s largest platforms for African content.

Rwanda is another notable example, where government leadership and investment has enabled growth across both supply and demand. The strength of Rwanda’s ICT policy is central to this growth, as is ownership and leadership of the country’s digital future, which comes straight from the top, President Kagame.

Kenya stands out due to the depth of its ecosystem, which includes leadership in public private partnerships, flexible regulatory environment, and investments in innovation. Lastly, South Africa’s high quality talent, access to capital, and concentrated tech ecosystem underpin its positioning for success.

TCB: How is this technology changing the lives of Africans? What humanitarian consequences does this growth offer for Africans?

RM: Technology is changing lives in a number of ways but there are three areas that stand out for me - visibility, access, and data.

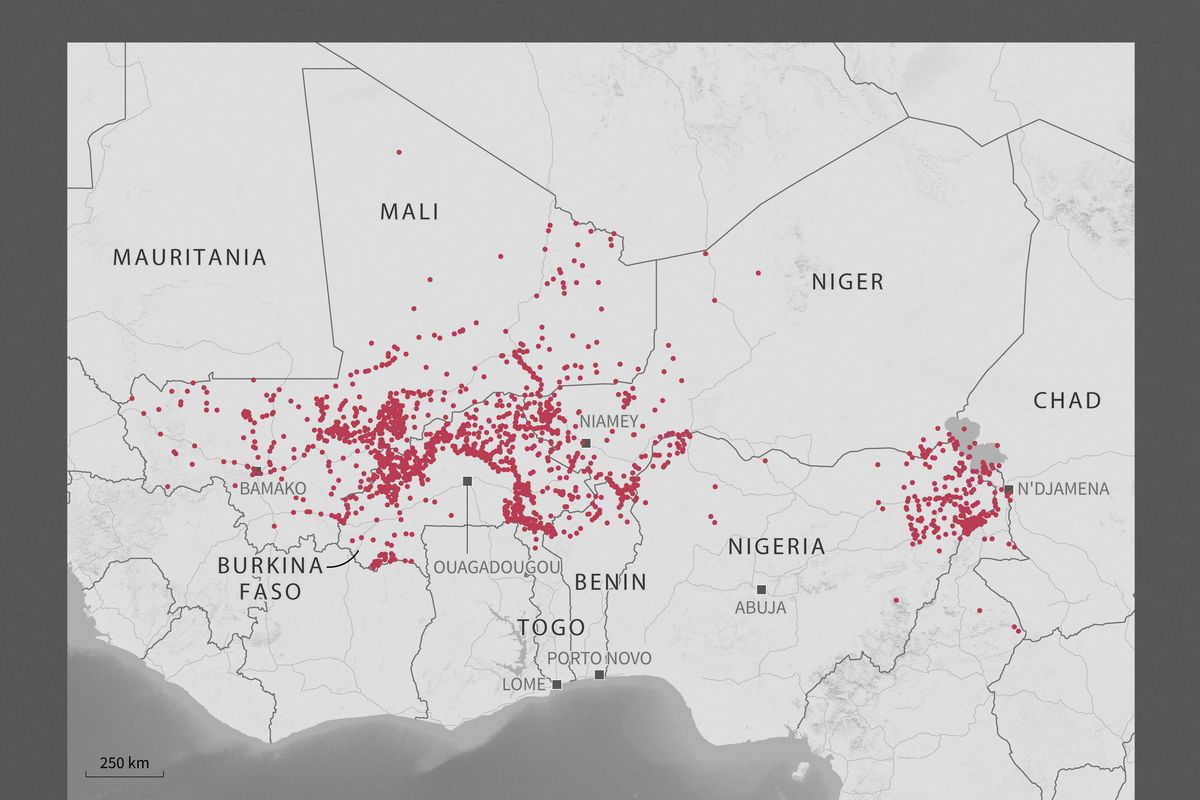

In terms of visibility, technology is creating better information about what is happening, where people are, etc. The speed with which we can predict, respond, and recover to humanitarian and environmental crises is improving. From communicating movements of displaced populations to filtering information back to aid organizations, technology is increasingly creating a voice for Africans in times of crisis or disaster.

Second, technology is driving access, particularly for small and medium-sized enterprises (SMEs). This growth is being realized through better access to information, finance, customers, and intelligence. SME’s are easily the largest contributor to employment across Sub-Saharan Africa, but face profound challenges when it comes to accessing finance, markets, and support.

And finally, data. As the costs of hardware and data continue to decline, the pace of access will drive an increasing number of users online. Alongside lower costs of access, new mobile and internet-enabled solutions will continue to emerge, creating an astounding amount of data and information, particularly about market segments that we still know very little about (emerging middle class and lower income consumers).

TCB: Is there a fear that the industry is growing too rapidly? What would be the negative consequences of this?

RM: Globally, there may be a fear of growing too fast, but within Africa, the real fear should be that access to technology is not growing fast enough. Access to the right kind of capital is still a constraint – for example, seed funding is desperately needed for early stage ventures.

There is also a significant gap in talent in the form of digital literacy/capabilities, but also business skills to start and grow a business. We need to enhance technical capabilities (software developers and engineers) and business expertise (how to get start-ups to have systems and processes that position them for success as a businesses) in order to address the talent challenge at all levels.

Another problem is that tech infrastructure is still not reaching the majority of those in Sub-Saharan Africa.

In terms of negative consequences: the risk of overinflating the opportunity and not realizing the results might deter investors from investing in Africa.

TCB: What opportunities remain for this industry and what is the general outlook for the ICT industry?

RM: The outlook absolutely needs to be positive, but tempered. We still struggle with inefficient capital flows to seed and grow promising businesses, and talent is a major challenge. But we are seeing innovation and results. The opportunity can’t be denied.

One of the areas that’s been most interesting to me lately, is how technology is driving the growth of a sharing economy. From Uber to AirBnB, the emergence of a sharing economy creates space to better leverage assets by aligning supply and demand, thereby driving opportunities for economic empowerment. Shared economy business models are transforming industries and creating disruption while establishing more effective infrastructure, which is extremely important in an asset-scarce or asset-burdened continent.

Robin Miller is an Associate Partner in Dalberg Global Development Advisors’ Johannesburg office, where her work focuses on ICT strategy, access to finance, global health, and institutional strategy. Dalberg is a strategic advisory firm dedicated to global development and innovation. Ms. Miller has recently worked with the World Bank, the South African National Planning Commission, one of the largest telecommunications operators in South Africa, and a large African based international investment holding company on issues including ICT investment strategy, design and development of new mobile technology ventures, organizational reform, and performance evaluation.