It’s no secret that Taiwanese factories produce much of the world’s computer chip and semi-conductor supplies used in a variety of products from smartphones to medical equipment. That alone may not seem cause for concern, but when you layer in an increasingly hostile geopolitical environment, a better picture of national security risk emerges.

China views Taiwan as a breakaway republic and has vowed to reunify. In recent months, the Chinese military has increased exercises and provocative moves that some, including Cipher Brief experts, have said are efforts to intimidate Taiwan while reinforcing a strong message for China’s domestic audience. The US, for its part, has increased military support to Taiwan, via the sale of US military hardware and technology.

But what about Taiwan’s economy and its role in the global tech race? Taiwan Semiconductor Manufacturing Co. (TSMC) the world’s largest contract chipmaker, announced in May of this year plans to build a $12 Billion facility in Arizona. And in October, Microsoft announced plans to build a cloud data center in Taiwan.

As the economic war between China and the US heats up, what role does Taiwan, a leader in the manufacture of semiconductors, play in the race for tech dominance between the two biggest players in the game?

Background:

- The Taiwanese economy is generally strong and prosperous. After a short economic downturn at the end of World War II, Taiwan’s economy grew exponentially. During the 1970-80s industrialization soared, and Taiwan’s economy developed to high-level industries. Their electronic expertise attracted foreign investment and increased trade opportunities.

- The Taiwanese economy is driven by petrochemicals, machinery and high-tech electronics exports, earning more than $60 billion from the semiconductor industry.

- The majority of Taiwanese exports are to China are ($73.9 billion), Hong Kong ($38.4 billion) and the United States ($33.6 billion).

- China and the US are the two main importers of Taiwanese semiconductors and in 2019 Taiwan was the second largest semiconductor manufacturing economy in the world. It’s been reported that nearly 10,000 computer scientists enter the Taiwanese workforce every year which helps to sustain the Taiwanese semiconductor industry and innovate technological developments in areas like 5G and the Internet of Things.

The Semiconductor’s Role in the Global Tech Race:

- Semiconductors’ are used in integrated circuits, diodes, and transistors, which are essential to powering and operating electronic devices. Innovation in Artificial Intelligence, 5G wireless communications, high-performance computing, and quantum computing rely on semiconductors.

- Economic and trade deals regarding the manufacturing of semiconductors can directly impact a nations’ ability to engage in tech advancement, so their role in the global tech race is crucial, in particular with China and the US. China currently lacks sufficient infrastructure to outpace U.S. production of semiconductors.

- China’s 2015 Made in China 2025 strategy emphasized their intent to develop semiconductor manufacturing and production and more recently President Xi reinforced China’s intent with the release of a 5-year plan for China to achieve technical independence.

- A recent study by the Boston Consulting Group calls for a new $20-50 Billion US federal program of tax incentives and spending in order for the US to maintain dominance and “be effective in reversing the last 30 years’ declining trend in US semiconductor manufacturing.”

The Cipher Brief caught up with four experts to get their unique perspectives on how the US-Taiwan economic relationship, and Taiwan’s role in the critical global tech race is likely to play out and how it is likely to impact future national security.

Susan M. Gordon is former Principal Deputy Director of National Intelligence. Dr. Sarah Sewall is Executive Vice President of Policy at In-Q-Tel. Cipher Brief Expert James Lewis is a Senior Vice President and Program Director at the Center for Strategic and International Studies (CSIS) and Cipher Brief Expert Ambassador Joseph DeTrani is a former special advisor to the DNI and served over two decades with the CIA.

Susan M. Gordon, Former Principal Deputy Director of National Intelligence

Taiwan is incredibly important over the next five years. The U.S. and China have both under-invested in their manufacturing capabilities and are hugely dependent on Taiwan—the advanced capabilities of both go through Taiwan’s semiconductors. That said, beyond five years, the situation should change for both. The U.S. has a decision to make about addressing this dependency. It seems to be moving toward rebuilding the manufacturing capability to match its design superiority. If it does, the situation will change for the positive. If it doesn’t, this supply chain vulnerability becomes more problematic. Expect China to face and address this situation as well.

Dr. Sarah Sewall, Executive Vice President, Policy, In-Q-Tel

China’s effort to become a global leader in semiconductors is prompting the United States to consider new policies to promote innovation and supply chain security. As China develops its own capacity to design and produce cutting edge chips, Congress is considering measures to increase funding for disruptive research and support for boosting domestic semiconductor manufacturing capabilities such advanced packaging of chips.

James Lewis, Sr. Vice President and Program Director, CSIS

China was on the same trajectory as Japan and Korea in building its indigenous chip industry, but U.S. actions have slowed that down. China’s behavior has raised concerns around the work. Their intent is to drive western companies out of business. The Koreans and the Japanese know this, as do the Americans. China will become a competitor, but they may not be a part of the larger chip ecosystem, which means a bifurcation that will keep China in second place for a long time.

Susan M. Gordon, Former Principal Deputy Director of National Intelligence

What we might not be thinking about is the impact of a more independent, more isolated China that has acquired sufficient insight through its intelligence and IP-theft to pair with internal investment. Not only are they poised to have peer-level capabilities, but as they diverge in approach, we will have to invest to make sure we don’t lose touch with them.

Dr. Sarah Sewall, Executive Vice President, Policy, In-Q-Tel

The decades long shift of global semiconductor production to Asia and the ongoing trade dispute with China has highlighted vulnerabilities in the microelectronics supply chain. Given the lack of merchant fabrication capacity within the United States, TSMC’s recent announcement of a commitment to build a manufacturing plant in Arizona is a positive development. While the United States cannot practically hope to onshore all microelectronics fabrication, it should create a national microelectronics strategy that, amongst other things, prioritizes the developing new technologies that enables safe and secure operation within a zero-trust global supply chain.

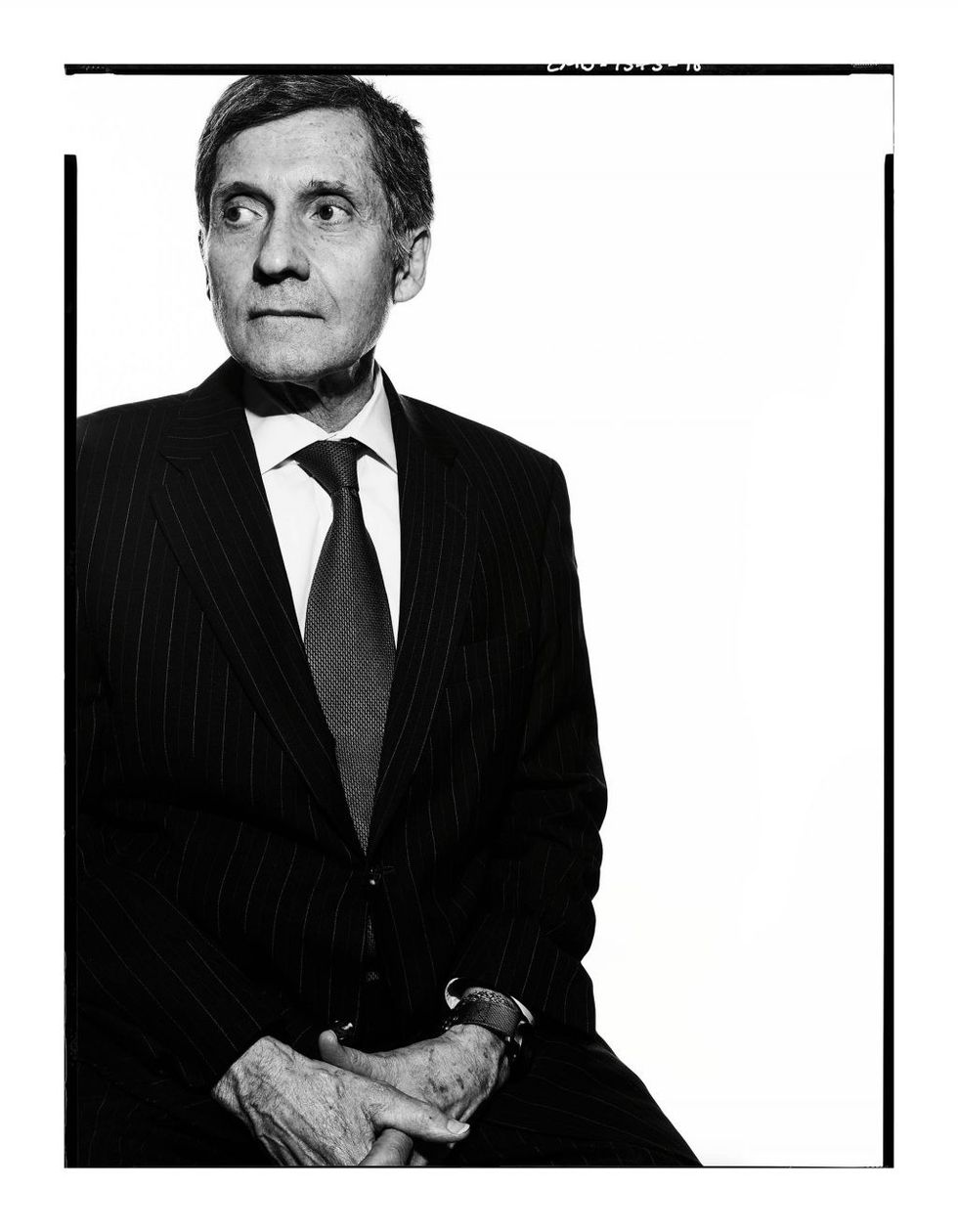

Ambassador Joseph DeTrani, Former Special Advisor to the Director of National Intelligence

I'm sure China is saying to businesses that are investing in Taiwan, "We, the government of Xi Jinping, will impose, whatever sanctions are necessary on those companies that are doing greater business or doing business period with Taiwan." They'll look for levers that they have in China to penalize and sanction those companies that have business in Taiwan. But I think the flow is moving into Taiwan, and we see it now with Microsoft, and we see it with the $1.8 billion sales agreement that's moving forward with Boeing and Raytheon and Lockheed Martin. I think we'll continue to see a greater investment in Taiwan. That means tension will be ratcheted up accordingly because China is going to respond in a very negative way.

James Lewis, Sr. Vice President and Program Director, CSIS

The biggest problem with digital infrastructure security isn’t a supply chain problem, it’s the fact that we have a powerful, well-resourced opponent who feel like it’s an open space where they can do whatever they want without any risk of consequence. It’s like the oceans in the 17th century, no rules and no penalties. That’s the biggest threat right now.

Cipher Brief Intern Madison Lockett contributed research for this analysis. Madison is a senior at The University of Texas, Austin.

Read also How Taiwan’s Manufacturing of Semiconductors Impacts the World exclusively in The Cipher Brief

Read also Where is Taiwan’s Military Buildup Headed exclusively in The Cipher Brief

Read more expert-driven national security insight, analysis and perspective in The Cipher Brief