EXCLUSIVE EXPERT PERSPECTIVE -- One would have thought that the outbreak of a major war between Iran and Israel with daily missile salvos, would have immediately led to an energy crisis, but trauma in the market that once would have seemed extraordinary, barely makes the headlines today. So, what does this tell us about how today’s energy markets are responding to the potential of violence in a chokepoint where 20 million barrels of crude oil and oil products move through the Strait of Hormuz each day?

“Countries and traders have learned that tectonic developments that don’t impact supply or demand products often produce only short-term fluctuations in the market,” says energy expert Norm Roule, who, since retiring from ODNI as the National Intelligence Manager for Iran, has been routinely traveling the region meeting with senior leaders.

“The chronic turbulence in Europe and the Middle East, particularly since the 2019 attack on Abqaiq, appears to have baked geopolitical risk resilience into the market. Energy markets are well supplied. U.S. production remains significant, despite predictions of modest declines in 2026.

In a Cipher Brief Subscriber+ exclusive interview, we talked with Roule about demand, the overall global market and the impact of Chinese stockpiles.

Norman T. Roule

Norman Roule is a geopolitical and energy consultant who served for 34 years in the Central Intelligence Agency, managing numerous programs relating to Iran and the Middle East. As NIM-I at ODNI, he was responsible for all aspects of national intelligence policy related to Iran, including IC engagement with senior policymakers in the National Security Council and the Department of State.

The Cipher Brief: The President has given Iran two weeks to accept a diplomatic solution to demands that it give up its ambitions to develop a nuclear weapon, which the U.S. and Israel insist is the focus of the country’s nuclear program. What energy-related developments do you expect to be occurring behind the scenes over the next two weeks?

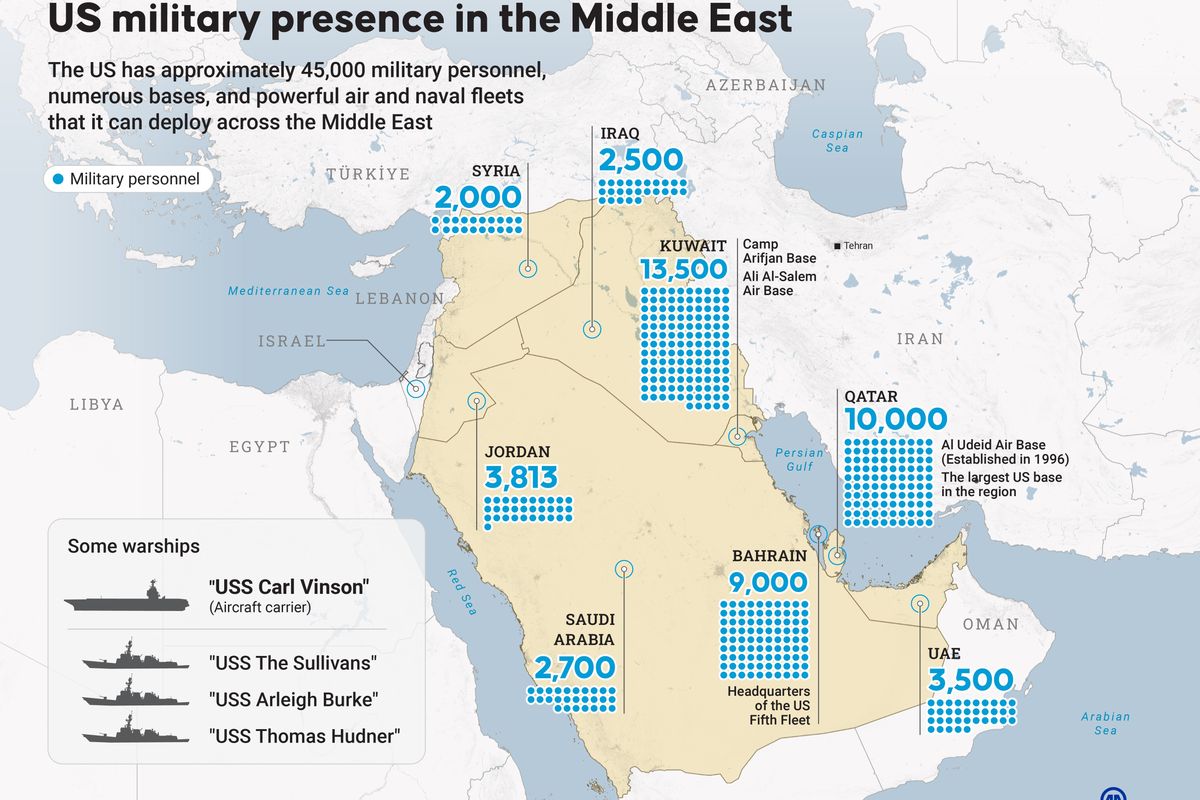

Roule: The U.S. is almost certainly working with the Saudis and Emiratis, who will use their diplomatic channels with Iran to discourage escalation, to manage OPEC, and to prepare their oil sectors for increased production and export through alternative channels to replace any oil lost due to the closure of the Strait of Hormuz (SoH). I would also expect that the U.S. is working with these countries to provide support for their air defenses. Washington will be busy when it comes to working with other regional partners to prepare the region for what could be a sharp conflict.

The two-week delay in a U.S. attack will provide welcome time for planning with key economic partners to discuss potential releases from their strategic oil stockpiles. On this last point, our strategic needs differ significantly from those of decades past, given our robust domestic production. Nonetheless, this crisis reinforces the need to avoid drawdowns of our strategic oil stockpile for political reasons alone, as some have claimed was done in the recent past.

The Cipher Brief: What is the near-term outlook for oil prices then, and how do you expect higher oil prices to impact the global economy?

Roule: As long as the threat of a U.S. attack on Iran remains a possibility, prices are likely to remain in the upper 70s, with possible further spikes driven by dramatic moments in the conflict. Depending on the intensity of the conflict, prices could reach $120 or $140. If the conflict is brief, the impact is likely to be minimal. But longer and higher oil prices bring a mix of issues. Oil-producing countries, including the United States, will benefit from higher oil revenues, while developing countries and those with limited energy import reserves are likely to suffer. Higher oil prices will contribute to higher inflation, constraining growth and will sharpen the call for interest rate cuts. President Trump has already complained that this crisis has pushed up oil prices and complicated his efforts to bring down inflation.

The Cipher Brief: Iran has threatened to close the Strait of Hormuz multiple times over the past few years, knowing that is a powerful way to gain the attention of the world’s diplomats and media. As we see this threat resurface, which countries are most likely to be affected if Tehran makes good on the threat?

Roule: The oil from the SoH reaches global consumers, but the vast majority goes to Asian markets. China, India, South Korea, Pakistan, and Japan are the primary purchasers.

The U.S. imports little crude oil and condensate from the SoH. In 2024, our imports from the region reached around 500,000 b/d, or only around seven percent of our total crude and condensate imports. So, a decision by Iran to shut the SoH would not directly hurt the U.S., and they know it.

The Cipher Brief Threat Conference is happening October 19-22 in Sea Island, GA. The world's leading minds on national security from both the public and private sectors will be there. Will you? Apply for a seat at the table today.

The Cipher Brief: What are the alternatives to move oil outside of the region if the Strait of Hormuz is closed?

Roule: Up front, we need to remind ourselves that we are talking about replacing an artery that moves around fifteen per cent of global crude oil supply and 20% of liquefied natural gas. That speaks of the importance to the global economy, but it is just as important to think about this in terms of volume and frequency of the quantity of energy shipped, the number of distribution points involved, and the shipping architecture needed to move the energy. In terms of national source, I believe over a third of the oil that transits the SoH is produced by the Saudis.

We shouldn’t ignore the impact closure of the SoH would have on the economies of the Gulf countries which import a tremendous amount of food and other commodities that sustain their populations and economies. The region’s ports are critical to region. Jebel Ali Port, for example, is the tenth largest container port in the world.

However, sticking to oil and other energy exports, there are additional routes we could use, but they cannot replace the SoH in terms of quantity. However, the use of these options could provide some relief, both in terms of exports and costs. Ships using these outlets would save on delivery costs and avoid the high insurance premiums associated with war zones. Of course, Iran could choose to attack these routes in the event of a conflict using missiles, drones, or even terror groups. Gulf Arab states have worked hard with the U.S. and other partners to build domestic defenses against such threats as well as to establish system redundancies to restore operations in the case of a successful attack.

The most important would be the Saudi East-West Pipeline. This 1,200-kilometer pipeline connects Saudi Arabia’s Eastern Province oil fields and facilities at Abqaiq to an export terminal in Yanbu on the Red Sea. The pipeline has a capacity of around five million barrels per day. I believe it carries only a tenth of that today. In 2019, Riyadh converted some of the system's natural gas lines to handle crude oil, which allowed the route to handle around seven million barrels. So, if necessary, we should feel confident the Saudis will be creative with their domestic pipeline architecture to maximize exports. Using this route would add distance to those destined for Asia and would require shipments to pass through Yemen, thus exposing them to Houthi attacks.

We also have the Emirati outlet in Fujairah. This line fluctuates between 1.5 and 1.8 million barrels per day, to a point outside the SoH that is home to the world’s largest underground oil storage facility. Abu Dhabi uses a 400-kilometer pipeline to ship Murjan crude from the Habshan oil fields. This line can carry about 500,000 b/d of crude. We are already seeing increased interest by Asian buyers in contracts for loads from this source, as well as Omani crude, which also loads outside the SoH.

Last, Iran would try to use Jask Port. Opened in 2021 on the Gulf of Oman, the port could allow Iran to export around 300,000 b/d from a pipeline that begins at Goreh in the north. However, the output here is modest to the global market. Iran’s priority at this point certainly isn’t maintaining export revenue or market share. I don’t see the U.S. putting an oil blockade, but if that ever happened, it wouldn’t be difficult to halt exports from this outlet.

The Cipher Brief: How would Iran try to close the SoH, and how difficult would it be for U.S. forces to respond?

Roule: My sense is that none of the actors involved in the current conflict, including Iran, want to see the war expand into the Persian Gulf. Israel’s focus will be on Iranian energy targets. Tehran may believe it has no choice but to attack U.S. bases in the wake of a U.S. strike on Fordow, or it could believe actions in the Gulf would pressure the U.S. and Europe to end the conflict. This strategy works only if Tehran believes its targets will respond by pressuring Israel to end hostilities.

The problem for Iran is that whereas the threat of action against the Gulf has diplomatic value, the reality is Tehran can do little damage to Israel in these waters. Closure of the Gulf will hurt Tehran as much as its adversaries. Iran depends on the waterway not only to export its own oil, but for a significant amount of its food imports. Shutting the Strait would damage the world economy in the short term. For Tehran, the diplomatic cost would be severe. It would put an end to the détente that has shaped Iran’s relations with the Gulf Cooperation Council. The economic damage to emerging economies of an oil price spike would be tough to bear, costing Tehran’s diplomatic support at the United Nations. Finally, the action could even contribute to the demise of the regime as countries unite to open the waterway and turn on Iran’s military at a time when Israeli’s actions seem to undermine the regime’s hold on power in Tehran and other cities.

Nonetheless, Tehran has a number of disruption options. At the low end, the actions are meant to message Iran’s potential power to support its threat messaging. For example, We’ve already seen reports of GPS jamming interference, which makes it difficult for ships to navigate the crowded waters and could lead some to cross into Iranian-claimed territory inadvertently. Cyber-attacks against ships and regional energy entities are a potential option for Tehran. Gulf Arab states have worked hard to defend against Iranian cyber attacks but the pool of potential economic and human cyber targets is vast.

Next on the escalation ladder, we have the potential for harassment by drones, military guards in speed boats, calls for sanitary inspections, claims of smuggling, or intrusions into national waters. U.S. and partner forces could assist by accompanying vessels. Gulf countries and their commercial partners have reduced traffic to the Gulf to minimize exposure to Iranian attacks.

As your readers will agree, the extreme case would be if Iran chose to mine the SoH or use its submarines or use coastal or ship-borne missiles against tankers or oil platforms. The U.S. would respond quickly of course, drawing upon existing regional naval and air units as well as those brought by our carrier task forces. Washington would also likely seek partners.

The United Kingdom is already on site, and burden sharing would extend to Gulf naval partners as well as India. New Delhi has strong strategic interests in keeping the waterway open, and there is a precedent here. In 2019, India escorted its oil tankers in the Strait of Hormuz during a period of heightened tensions with Iran. If Iran did undertake mining the Gulf or threatening traffic with coastal missile or small naval operations, restoring shipping operations would likely require a several-week military campaign.

My sense is that in the near term, Iran’s rhetoric on a potential Gulf threat will continues, but all parties will do what they can to prevent incidents in the Gulf region that could escalate into open conflict. The U.S., British, and other partners in the region have prepared for years for such this threat and our regional military leadership is traditionally among the best our nation has to offer. Further, recent experiences against the Houthis have only sharpened preparedness of a force that has spent years dealing with Iranian harassment of vessels. If conflict in the Gulf does erupt, we shouldn’t doubt that Iran will disrupt shipping, but we should be well-equipped to deal Iran a devastating response to Iran’s military capabilities throughout the Gulf.

The Cipher Brief: Given the overproduction in OPEC+, wouldn’t the group be able to replace oil lost through a closure of the SOH?

Roule: The challenge is that whereas much of OPEC’s spare capacity could be brought on within a few weeks, the bulk would be locked in the Persian Gulf. It probably would be better to think about the market rebalancing through a combination of increased OPEC production, shifted distribution, and strategic reserve releases designed to deal with what the world would hope would be a relatively short conflict.

The Cipher Brief: What about potential strategic surprises from China?

Roule: Perhaps the only surprise about China in this crisis is that some expected it to behave differently from the way it has in the past. Iran is a key component of China’s Belt and Road Initiative, the BRICs, and the Shanghai Cooperation Organization. However, China has avoided involvement in regional security issues, leaving that to the United States and its partners. China also remains the primary buyer of Iranian oil at deeply discounted rates. These purchases are significant to its smaller refineries, which would be unwilling to pay the full price demanded by any Emirati or Saudi replacement oil. China’s diplomacy has not played a role in shaping the global response to this developing crisis and once again underscored the limits of its influence in the region. Beijing opposed the recent International Atomic Energy Agency censure of Iran, condemned Israel’s attacks, and held a few ministerial meetings. China likely evacuated some of its citizens from Iran. It seems highly unlikely that Beijing would take any steps to involve itself militarily.

Beijing likely believes that it can stand out of this conflict and still retain its influence with Iran, its role as Iran’s chief energy customer, a key place in Iran’s economy (and nuclear industry), while letting the U.S. pay the diplomatic and financial costs of maintaining regional security. The conflict may even bring benefits to China. Beijing’s military has been able to watch Israel operate U.S. weaponry in action and the U.S. naval and air operations in the region have provided similar intelligence gathering opportunities. Beijing will likely use these lessons as it plans to deal with U.S. defense of Taiwan.

Even in an extreme scenario where the Islamic Republic could fall and be replaced by a pro-U.S. government, China has little incentive to intervene. Riyadh and Abu Dhabi are pro-U.S. and yet they remain essential and profitable partners for Beijing. There is no reason to think a pro-U.S. Tehran would be any different.

The Cipher Brief: What potential wild cards do you see?

Roule: Every crisis produces secondary and tertiary impacts. The natural gas story seems the most likely to cause such consequences here. Qatar produces approximately 20 percent of the world's LNG, and all of its product must transit through the Strait of Hormuz (SoH). Violence in the Gulf will threaten this important energy source for many countries.

It was recently reported that Israel conducted a drone strike against a refinery in the 2-200-mile South Pars Gas Field shared by Qatar and Iran. The attack had no impact on Qatari operations or even any significant impact on Iranian operations. Yet it made headlines. But it shows that any military operations touching that that field will touch the markets immediately. Closer to the region, Iranian attacks on Israel’s gas industry will impact Egypt and Jordan. Israel exported around ninety percent of the production of its Chevron-operated Leviathan gas field – its largest – to these two countries in 2024. These are critical imports: Egypt depends on Israel for 15 to 20 percent of it natural gas. Israel closed exports when its war with Iran began. The halt caused Egypt to almost immediate halt fertilizer production. After the decline in Iranian missile attacks and negotiations with Egyptian officials, Israel just agreed to restore gas to Cairo.

Updated on June 21 adding additional details.

Are you Subscribed to The Cipher Brief’s Digital Channel on YouTube? There is no better place to get clear perspectives from deeply experienced national security experts.

Read more expert-driven national security insights, perspective and analysis in The Cipher Brief because National Security is Everyone’s Business.