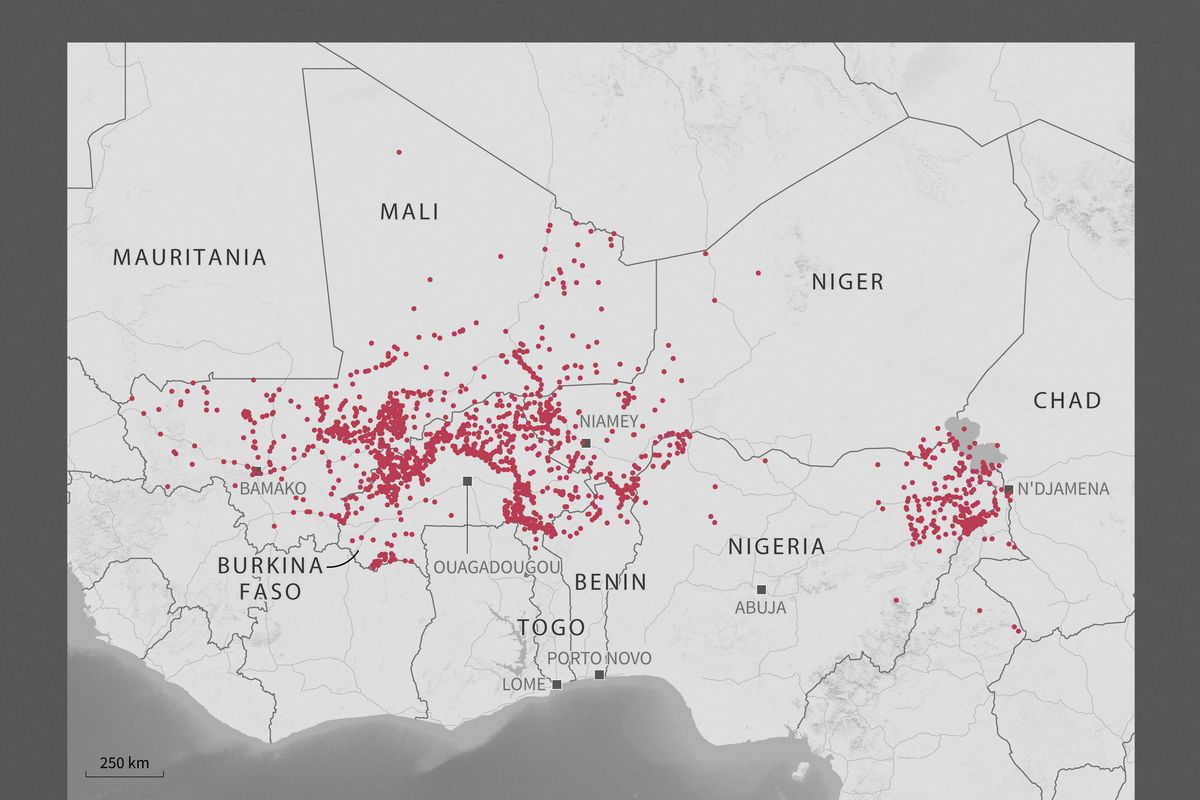

An emerging nexus between terror and crime in Europe needs to be addressed with an even stronger nexus between law enforcement, the intelligence community, and the financial industry. The crime-terror nexus is not a new phenomenon. Forgery, weapons procurement, and cross-border smuggling are but a few examples of criminal activities linked to terrorism. In regions of instability – like Mali, Libya, Syria, and Iraq – terrorist groups often work alongside organized crime groups to accomplish business goals. What is new is the growing convergence between terrorists and criminals, often petty criminals at that, and the trend being exported from unstable states to the European continent.

A common characteristic of terrorists and criminals seems to be the desire to function outside of societal norms. Director of Future Conflict and Cyber Security at IISS Nigel Inkster explains that immigrant ghettos in Western Europe, like Molenbeek in Belgium, the municipality made infamous by the March 2016 Brussels attacks and the November 2015 Paris attacks, are breeding grounds for young people who use criminality to earn money and acquire a sense of self-esteem and social status.

Inkster, who is also a former Deputy Chief of the British Secret Intelligence Service (SIS), says this alienation from main-stream society heightens the attractiveness of terrorist organizations. “A culture that encourages lawlessness and contempt for established social norms risks creating a breeding-ground for violent extremism in the same way that has happened in marginalized regions of the developing world with young men and women being drawn to jihadism because they feel they have nothing to lose,” Inkster said.

Indeed, many of those involved in the Paris attacks led secular lifestyles that included drugs and alcohol (an apparent contradiction to the traditional profile of the staunch Islamist). At a Senate Foreign Relations Committee hearing on April 12, Director of the Stein Program on Counterterrorism and Intelligence Matthew Levitt noted, “If you look at most of these people who are involved in crime and still drinking and using drugs after they’ve sort of become Salafists, or they become Islamic State […] they’re being radicalized to the idea of the Islamic State far more than any idea of Islam.”

Another contradiction between the Islamic faith – that many terrorists have traditionally fought for – and current trends in terrorism is the use of crime to finance operations. According to a 2012 European Parliament report on the crime-terror nexus, fragmentation of militant Islamist groups and thus a decrease in centralized support has made crime justifiable when used for financial or operational needs.

This is where the private sector can play a pivotal role in combating organized crime and terror attacks. Fraud, money laundering, and all dubious transactions need to be identified and reported by banks, investment firms, and other financial institutions. The European Parliament recommends, “The financial sector must work more closely with government agencies to identify gaps in current regulations and implement innovative techniques to address these issues” because “although in theory one way of combating the linkages between OC [organized crime] and terrorism is to follow money trails, in reality it takes considerable resources to trace money flows.”

Europe is, in fact, working together toward a common banking system, which could facilitate information sharing and thus make criminal/terrorist financial activity easier to detect. In response to the 2008 sovereign debt crisis, the EU established the European System of Financial Supervision (ESFS), consisting of both micro- and macro-prudential authorities, including the European Supervisory Authorities (ESAs) and the European Systemic Risk Board. The national supervisory authorities of EU member states are also involved.

Although the ESFS has performed relatively well, according to a review conducted by the European Commission in 2014, the mandate of the ESAs is “to sustainably reinforce the stability and effectiveness of the financial system throughout the EU.” There is no mechanism to bolster identification of illicit financial transactions. Rather, the goal is largely along the lines of the German Bundesbank and the European Central Bank (ECB): maintain stability, that is minimize currency fluctuations and preserve a healthy inflation rate across the European continent.

European financial leaders – from both the private and public sectors – must work with EU-level and national government leaders, along with security apparatuses (including law enforcement, military and intelligence services) in order to thwart the budding crime-terror nexus in Europe.

Although Europe is in a vulnerable position, Tamara Makarenko, who is Managing Director at West Sands Advisory based in the UK, says “Current and historical cases that have played out in Afghanistan, the Balkans, Mali, Iraq, Syria, and the tri-border area of South America are not likely to play out in Europe. However, this is not to say that relative socio-political and economic stability will not lend itself to various forms of the crime-terror nexus.”

Kaitlin Lavinder is an International Producer with The Cipher Brief.